More news

- Moving fluids: Meeting the challenge of transferring dangerous liquids without common pitf...

- Coatings resins market expected to surpass US$97.5bn by 2035

- 3D printed nanocellulose upscaled for green architectural applications

- View from the U.S.: Anticipating an M&A rebound

- Covestro and Delta Coatings demonstrate durability of polyurea-based linings for man-made ...

Recently, the Asia Coatings and Inks Federation (ACIF) was established to represent the world’s largest and most dynamic coatings region. Here, in ACIF’s new regular column for PPCJ, Douglas Bohn and Xilin Li, Orr & Boss Consulting Inc., give an overview of Asia’s paint and coatings industry and the key trends in the market

The Asia Pacific coatings market is the largest and most dynamic in the world. The market is currently seeing challenges now due to the global economic environment but despite these challenges, the market is still growing. The markets in South Asia, South East Asia, and Central Asia all continue to be attractive.

Due to the dynamic nature of the Asia Pacific coatings market, a new organisation has been organised. The Asia Coatings and Inks Federation (ACIF) was established in Hong Kong this past November. The goal of ACIF will be to represent the coatings industry across Asia.

Paint & coatings summary

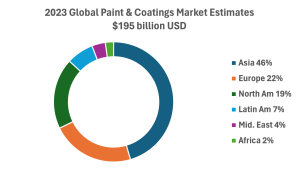

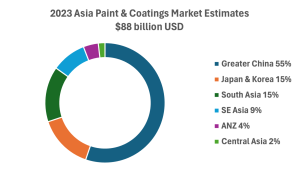

Orr & Boss estimates the market at US$88bn. At that, it represents 46% of the global paint and coatings market.

Within Asia, Greater China is by far the largest market followed by Japan & Korea and South Asia.

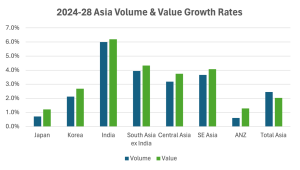

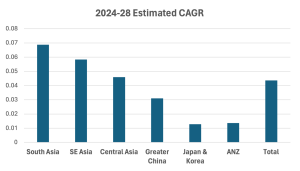

In 2023, the market grew at an estimated 1.1% volume rate and value up 3.8%. In 2024, we expect the Asian market to be up 2.4% in volume and 2.0% in value. These are down a bit from our previous estimates but Asia Pacific has continued to grow faster than the global average. India, South Asia, Central Asia and South East Asia are all fast growing markets.

Going forward, we expect the trends to remain similar with India, South Asia, Central and South East Asia being the growth leaders.

READ MORE:

Key Trends in the Market

- Consumers across Asia are downgrading their paint purchases. So, consumers who used to buy premium priced paints are now buying mid-tier paints and those that used to buy mid-tier paints are now buying lower priced paints.

- China’s growth rate is slow due to continued struggles in the property market, as well as manufacturing remaining slow. On the positive side, we believe that the market is no longer declining and there are some tentative signs of growth in the manufacturing sector, which should help out the industrial coatings segment.

- China real estate market has been, and still is, under pressure and deco paint makers are seeking alternatives, mostly into industrial coatings.

- Within China, there is mergers & acquisition activity in the decorative paint segment: BNBM acquired Carpoly and Huarun was divested by Sherwin-Williams and acquired by AkzoNobel. Also, Behr announced withdrawal from China. This is similar to the DAW decision to divest its China business.

- India and South Asia continue to be the growth leaders followed by South East Asia and Central Asia. In these regions, consumers have been downgrading their paint purchases as discussed above.

- The key over-riding trend in the paint and coatings market has been the search for more sustainable solutions. Reducing the carbon footprint of the paint and coatings segment is important. This means reducing the CO2 emissions across the entire value chain of the paint & coatings value chain, including the raw material suppliers. Bio-based products that are less expensive are also desired.

- Globally, Electric Vehicle sales continue to exhibit robust growth. Sales are expected to grow by greater than 20% this year.

- Another important issue is the reduction of per-and polyfluoroalkyl substances (PFAS) products. Regulators across the world have become increasingly focused on PFAS segments. Thus formulating out PFAS containing raw materials is work that is on-going.

- The electrification of the global vehicle fleet continues to move forward. As part of this move to electric vehicles, automobiles are being light-weighted and new plastic composites are being used which often require different paints and coatings that adhere better to these substrates.

- Lower temperature cured products are also important as they lower the carbon footprint and save costs.

Conclusion

Overall, we expect the Asia paint and coatings market to continue growing this year, albeit at a lower level than pre-pandemic, as the China property market issues will drag down overall growth. But, growth should remain relatively high in India, South Asia, South East Asia and Central Asia. The high inflation and cost of living environment in the world is leading to consumers downgrading their paint purchases. The other major trend in the market remains sustainability. Reducing the carbon footprint, achieving net-zero emissions and other sustainability measures remain very important for the paint and coatings industry.