More news

- View from the UK: Navigating chemical policy and sustainability

- Architectural coatings in Nepal and Bhutan

- Focus on adhesives: Unveiling unbreakable bonds – Testing redefines physical strengt...

- Focus on adhesives: Henkel and Covestro collaborate for sustainability of engineered wood ...

- Advances in construction chemical technology: What’s new in 2024?

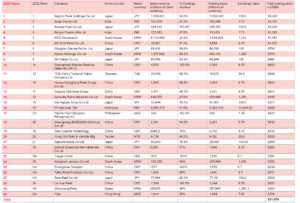

This year, the annual APCJ Top 25 Paint Manufacturers in Asia Pacific is brought to you by PPCJ and has expanded to include the top 30 coatings companies in the APAC region. Xilin Li, Terri Lin, Osamu Kirihara & Douglas Bohn of Orr & Boss Consulting Incorporated highlight the main figures and activities of the top 30 paint manufacturers headquartered in the world’s largest coatings market

Asia Pacific is the largest paint and coatings market in the world. Orr & Boss estimates that it is 45% of the global value of the paint & coatings market. It is also a fast-growing market, with sales revenue increasing by an estimated 6% in 2022. This was lower than forecasted at the beginning of the year but was still strong growth.

Given the size and growth rate of the Asian Paint and Coatings markets, there are numerous dynamic companies operating across the region. Due to that, we have expanded this year’s list from the Top 25 to Top 30 companies operating in Asia. Some of the key findings from this year’s list are:

- The top 30 paint companies had sales of US$31.1bn in 2022.

- If we compare only to those companies that were in last year’s list, sales revenues of these companies were up 8%.

- Nippon Paint further solidified its hold as the number 1 paint company in Asia Pacific, growing its sales to US$9.46bn.

- Due to the fast-growing nature of the India paint & coatings market, Asian Paints has risen to be the second largest paint company operating in Asia.

- New companies added to the list this year include Tianjin Dowill, Zhongshan Daoqum, Taiho Paint, Rock Paint, Chokwang Paint and Yips.

Below is the table showing the top 30 paint manufacturers headquartered in Asia Pacific:

READ MORE:

Number one in Asia: PPCJ speaks to Nippon Paint’s Gladys Goh

Asia regulatory round-up: June 2023

CALL FOR PAPERS – Asia Pacific Coatings Show conference in Thailand

Summary profiles

Summary profiles for the 30 companies are given below:

- Nippon Paint Holdings Company LTD

- Corporate Headquarters Location: Osaka, Japan

- Website: nipponpaint-holdings.com

- Ownership: Publicly Listed

- Peer Group: Sherwin-Williams, AkzoNobel, Kansai Paint, Axalta, PPG, and BASF

- Key Figures

- Total Revenue: JP¥1.3trn (US$10.1bn)

- Paint as a % of Sales: 94%

- Coatings Revenue: JP¥1.23trn (US$9.47bn)

- Coatings Volume: NA

- Geographic Sales: Asia except Japan 54%, Japan 14%, Australia & New Zealand 15%, Europe 9%, North America & Latin America 8%.

- Segment Sales: Decorative 60%; Auto OEM 10%; General Industrial + Coil 10%, Other Coatings (auto refinish, marine, & others) 18%, and Fine Chemicals (surface treatment) 2%.

- New Developments: Nippon Paint was again very active in 2022. The main activities include:

- Cromology of France became part of Nippon Paint in January 2022 and Jub became part of Nippon Paint in May 2022. Both of these acquisitions increased Nippon Paint’s footprint in Europe.

- In February of 2023, it was announced that Nippon Paint would acquire N.P.T. s.r.l of Italy, a producer of adhesives and sealants.

- For automotive applications, Nippon Paint is preparing a new factory in Okayama and production is scheduled to begin in the second half of 2023. Auto OEM topcoats, plastic coatings and other coatings will be produced in this factory.

- Nippon Paint Automotive is developing automotive decorative films which will be targeted for not only automotive but other markets where films are used.

- Nippon Paint automotive is expanding its automotive coatings plant in the US and will start production at another new plant in Vietnam in 2023.

- Asian Paints Ltd

- Corporate Headquarters Location: Mumbai, India

- Website: asianpaints.com

- Ownership: Publicly Listed

- Peer Group: AkzoNobel, BASF, Berger Paints, Jotun, Kansai Nerolac, Nippon Paint

- Key Figures

- Total Revenue: INR343.68bn (US$4.324bn)

- Paint as a % of Sales: 5%

- Coatings Revenue: INR335.09bn (US$4.34bn)

- Coatings Volume: NA

- Geographic Sales: India 86%, Middle East & Africa 4.6%, Asia ex India 4.0% (Nepal, Sri Lanka, Bangladesh, and Indonesia), South Pacific .4% (Fiji, Solomon Island, Vanuatu and Samoa

- Segment Sales: Decorative Paints in India 85.7%, Industrial Paints in India 2.8%, International business 9%, Home Improvement business of 2.5%.

- New Developments:

- Asian Paints intends to build a manufacturing facility for Vinyl Acetate Ethylene (VAE) and Vinyl Acetate Monomer (VAM). The proposed investment of approximately INR2,100 crores will occur over a period of three years. The investment is subject to entering into definitive agreements including technology license agreement for manufacturing of VAE & VAM and obtaining necessary regulatory and other approvals. The installed capacity of the manufacturing facility would be 100,000t/yr for VAM and 150,000t/yr for VAE.

- In October 2022, Asian Paints entered into definitive agreements to acquire 51% stake in Harind Chemicals and Pharmaceuticals Private Limited (“Harind”) from Aapex Power and Industries Private Limited,

- In October 2022, Asian Paints proposed to set up a white cement manufacturing facility. The facility will be a 60:40 partnership between the Company and Riddhi Siddhi & ASD. The initial manufacturing facility will be set up in Fujairah, UAE,.

- Kansai Paint Co Ltd

- Corporate Headquarters Location: Osaka, Japan

- Website: kansai.co.jp

- Ownership: Publicly Listed

- Peer Group: Nippon Paint, AkzoNobel, PPG and BASF

- Key Figures

- Total Revenue: JP¥509bn (US$3.92bn)

- Paint as a % of Sales: 100%

- Coatings Revenue: JP¥419.2bn (US$3.92bn)

- Coatings Volume: NA

- Geographic Sales: Asia 68%, Europe 23%, Middle East & Africa 8%, and Others 1%

- Segment Sales: Automotive 29%, General Industrial & Powder 25%, Decorative 28%, Refinish, Protective & Marine 11% and Others 7%

- New Developments:

- In 2022, the Helios group of Kansai announced that it was acquiring CWS Lackfabrik of Germany and the rail coatings business from Beckers.

- Kansai Helios completed its acquisition of the German coatings manufacturer Wefa.

- Berger Paints India Ltd

- Corporate Headquarters Location: Kolkata, India

- Website: bergerpaints.com

- Ownership: Publicly Listed

- Peer Group: Asian Paints, Kansai Nerolac, AkzoNobel

- Key Figures

- Total Revenue: INR122.1bn (US$1.575bn)

- Paint as a % of Sales: 97%

- Coatings Revenue: INR118.4bn (US$1.528bn)

- Coatings Volume: NA

- Geographic Sales: Asia Pacific 96.7%, Europe 3.3%

- Segment Sales: Decorative 85.9%, Protective 7.9%, Auto OEM 2.6%, General Industrial 2.5%, Powder 0.9 %, and Auto Refinish 0.2%.

- New Developments:

- A number of innovative offerings were introduced in the waterproofing segment. Products like Dampstop Duo, Dampstop Advanced, Dampstop Elasto (for roofs) were launched under convenience waterproofing platform.

- Multiple products were introduced in the interior and exterior wall coating space. Longlife Flexo (Elastomeric exterior coating with high dust pick up resistance), Silk Glamor Soft Sheen are a few notable introductions.

- KCC Corporation

- Corporate Headquarters Location: Seoul, South Korea

- Website: kccworld.co.kr

- Ownership: Publicly Listed

- Peer Group: AkzoNobel, Chokwang, Kansai, Noroo, PPG, Samwha

- Key Figures

- Total Revenue: KRW6.77trn (US$5.9bn)

- Paint as a % of Sales: 23%

- Coatings Revenue: KRW 1.558 trillion ($1.36 billion USD)

- Segment Sales (Orr & Boss Estimates): 40% Paint (includes Building, Industrial, Protective & Marine, Powder, Auto OEM, and Auto Refinish), 40% Building Materials, 20% Others.

- New Developments:

- KCC has launched the Firemask AQ Series, the first organic water-based fire resistant in Korea.

- KCC’s anti-rust and anti-fouling paints for ships were selected as “World-Class Products”. The World Class Products is a certification supervised by the Ministry of Trade, Industry, and Energy and awarded by the Korea Trade-Investment Promotion Agency (KOTRA).

- SK Shu (3Trees)

- Corporate Headquarters Location: Putian, China

- Website: shshu.com.cn

- Ownership: Publicly Traded

- Peer Group: Nippon Paint, Sherwin-Williams and Taiho

- Key Figures

- Total Revenue: CN¥8.86bn (US$1.63bn)

- Paint as a % of Sales: 11%

- Coatings Revenue: CN¥7.018bn (US$1.32bn)

- Geographic Sales: Asia 100%

- Segment Sales: Decorative 99.52% and Industrial Wood 0.48%

- New Developments:

- To support the vision of a green Olympic Games, 3 Trees was actively involved in the construction of the Beijing Winter Olympic projects by leveraging the strengths of its “six-in-one” integrated system of green building materials.

- Adhering to its corporate philosophy of “Imitation of Nature”, SK Shu continued to improve its ESG management capabilities in 2022. According to the MSCI ESG rating report on November, SK Shu obtained a BBB rating in the general chemicals industry, ranking among the top enterprises in the chemical industry in the world, and was successfully selected into the” ESG Best Practice Cases of Listed Companies in 2022.

- SK Shu also applied new technologies, new materials and new processes to improve its product lines. SK Shu remains committed to creating a one-stop integrated system of green building materials including interior and exterior wall coatings, waterproofing, thermal insulation, industrial coatings, floor paint, auxiliary building materials and construction services in the field of engineering.

- SKU Shu developed 238 new formulations in 2022 and upgraded 202 current formulations in 2022.

- Chugoku Marine Paints Ltd

- Corporate Headquarters Location: Tokyo, Japan

- Website: cmp.co.jp

- Ownership: Publicly Listed

- Peer Group: Nippon Paint, Kansai Paint, AkzoNobel, Hempel, Jotun, KCC, PPG

- Key Figures

- Total Revenue: JP¥98.41bn (US$757M)

- Paint as a % of Sales: 6%

- Coatings Revenue: JP¥98.02bn (US$754M)

- Geographic Sales: Asia Pacific 77.3%, Europe 22.7%

- Segment Sales: Marine 84.7%, Protective 15.3%

- New Developments:

- In 2022, Chugoku launched EPICON HR, a new heat-resistant epoxy coating for high temperature exposed areas. With its excellent corrosion protection and heat resistance, this product can contribute to reducing maintenance of steam pipes and other equipment on ship decks.

- To comply with the CII rating, Chugoku also focused on promoting its ultra low friction antifouling coatings which are expected to reduce fuel consumption due to their surface smoothness.

- Noroo Holdings Co. Ltd

- Corporate Headquarters Location: Anyang-Si, South Korea

- Website: norooholdings.com

- Ownership: Publicly Listed

- Peer Group: KCC, Kunsul, Samwha, Chokwang, Dongju, and PPG

- Key Figures

- Total Revenue: KRW1.04trn (US$803M)

- Paint as a % of Sales: 90%

- Coatings Revenue: KRW934bn (US$723M)

- Geographic Sales: Korea 80%, Other Asia 20%

- Segment Sales: Decorative 40%, Auto OEM 20%, Coil 15%, General Industrial 15%, Auto Refinish 8%, Others 2%

- New Developments:

- Noroo will introduce Korea`s first White Bio-Certified Paint. This product has acquired the USDA certified Biobased Product certification which is a first in the Korean market.

- The digital Marketing team of NOROO Paint is preparing the next steps on the metaverse platform ZEPETO so that more people can experience NOROO`s colors and paint virtually.

- Noroo remains committed to sustainability and green building practices and plans to continue developing sustainable products.

- SK Kaken Co. Ltd

- Corporate Headquarters Location: Osaka, Japan

- Website: sk-kaken-co.jp

- Ownership: Publicly Listed

- Peer Group: Nippon Paint, Kansai Paint, Rock Paint, AkzoNobel

- Key Figures

- Total Revenue: JP¥99.6bn (US$735M)

- Paint as a % of Sales: 93%

- Coatings Revenue: JP¥88.9bn (US$684M)

- Geographic Sales: Asia Pacific 100%

- Segment Sales (Orr & Boss Estimates): Decorative 70%, Protective 25%, Others 5%

- New Developments:

- In 2022, SK Kaken continued to promote the development of new customers and deepen its relationship with existing customers by offering products such as fire-resistant heat insulation and high weather resistance paints. SK Kaken will also attempt to raise the level of demand for its premium series and other high-end products.

- Guangdong Maydos Building Materials Limited Company

- Corporate Headquarters Location: Zhongshan, China

- Website: maydos.cn/

- Ownership: Private

- Peer Group: Nippon, Sherwin-Williams, Taiho, BARDESE, SK Shu, Carpoly

- Key Figures

- Total Revenue: CN¥4.03bn (US$602M)

- Paint as a % of Sales: 100%

- Coatings Revenue: CN¥3.3bn (US$602M)

- Geographic Sales: Asia Pacific 92.1%, Middle East & Africa 5.3%, South America 2.1%, North America 0.25%, Europe 0.25%

- Segment Sales: Decorative 74.05%, General Industrial 18.52%, and Furniture paint 6.43%.

- New Developments:

- Maydos products now include decorative paint, home decoration paint, furniture paint, project paint, industrial paint, waterproof paint, auxiliary products, energy saving board and adhesive.

- In 2022, Maydos was able to expand in its domestic China market. Both sales and profit throughout the year realised positive growth.

- In 2023, Maydos will continue to maintain the leadership of its products, technology, sales and service. Maydos will also pursue its sustainability initiatives by embracing its business philosophy of creating a low carbon and healthy world. Maydos also strives to keep an annual growth rate of over 30% with a goal of becoming one of the top companies in the Chinese coatings industry.

- TOA Paint (Thailand) Public Company Limited

- Corporate Headquarters Location: Bang Sao Thong, Samut Prakan, Thailand

- Website: toagroup.com

- Ownership: Publicly Traded

- Peer Group: AkzoNobel, Nippon Paint, Jotun

- Key Figures

- Total Revenue: THB65bn (US$589M)

- Paint as a % of Sales: 96%

- Coatings Revenue: THB8bn (US$566M)

- Geographic Sales: Thailand 83.4%, Vietnam 9.1%, Others 7.5%

- Segment Sales: Decorative paint 60.2%, non-decorative paint and coating products 35.8% and other business products 4%.

- New Developments:

- The company remains committed to its ESP initiatives. It received an Excellent 5 Star rating for Corporate Governance Report of Thai Listed Companies 2022 by the Thai Institute of Directors for 4 consecutive years.

- Toa Paint wants to continue to expand the business to become a leader in the decorative paint and coating products and construction chemicals.

- Hunan Xiangjiang Paint Group Co. Ltd

- Corporate Headquarters Location: Changsha, Hunan, China

- Website: xjtlgroup.cn

- Ownership: Privately Owned

- Peer Group: AkzoNobel, Axalta, BASF, Carpoly, Nippon Paint, and PPG

- Key Figures

- Total Revenue: CN¥3.95bn (US$589M)

- Paint as a % of Sales: 8%

- Coatings Revenue: CN¥3.5bn (US$523M)

- Geographic Sales: 100% Asia

- Segment Sales: Automotive OEM 73.5%, General Industrial 24.3%, Decorative 1.3%, and Powder 0.9%.

- New Developments:

- The company continues to invest in new product development with a focus on waterborne coatings, high solid coating, and powder coatings.

- In 2023, the company plans on continuing to invest in its auto OEM product line.

- Carpoly Chemical Group Co. Ltd

- Corporate Headquarters Location: Guangdong, China

- Website: carpoly.com

- Ownership: Private

- Peer Group: AkzoNobel, Nippon Paint, SK Shu, Sherwin-Williams, Zhanchen and Taiho

- Key Figures

- Total Revenue: CN¥3.47bn (US$518M)

- Paint as a % of Sales: 2%

- Coatings Revenue: CN¥3.44bn (US$514M)

- Geographic Sales: Asia Pacific 99.16%, Europe 0.36%, Oceania 0.28%, Middle East & Africa 0.14%, South America 0.01%, and North America 0.05%.

- Segment Sales: Decorative 72.6%, Industrial Wood 23.6%, General Industrial 2.4%, and Others 1.4%.

- New Developments:

- Carpoly won the 13th Golden Mouse Digital Marketing Award. Carpoly won the bronze award in the category of Digital Media Integration with its entry “My Kingdom”

- In 2022, Carpoly Group and Hunan Technology and Business University continued to carry out a student aid programme and setup the Carpoly Hunan Technology and Business University Student Grant Fund. Carpoly plans to invest 500,000 yuan from 2022 to 2026 to provide financial assistance to students.

- Samwha Paint Industries Co Ltd

- Corporate Headquarters Location: Seoul, South Korea

- Website: spi.co.kr

- Ownership: Publicly Traded

- Peer Group: AkzoNobel, Chokwang, Jevisco, KCC, and Noroo

- Key Figures

- Total Revenue: KRW646.07bn (US$500M)

- Paint as a % of Sales: 97%

- Coatings Revenue: KRW626.7bn (US$485M)

- Geographic Sales: Korea 81%, Asia ex Korea 18%, North America & MEA 1%

- Segment Sales: Decorative, General Industrial, Powder, Plastic, Automotive Refinish, Protective and Marine

- New Developments:

- Samwha Paints continues to invest in advanced technology, investment in facilities, and professional development. Samwha is also focused on environmentally conscious growth.

- Dai Nippon Toryo Co. Ltd

- Corporate Headquarters Location: Osaka, Japan

- Website: dnt.co.jp

- Peer Group: Nippon Paint, Kansai Paint, Chugoku

- Key Figures

- Total Revenue: JP¥72.85bn (US$560M)

- Paint as a % of Sales: 84%

- Coatings Revenue: JP¥61.1bn (US$471M)

- Geographic Sales: Japan 87%, Asia excluding Japan 12%, North America 1%

- Segment Sales: Protective 25%, General Industrial and Coil 30%, Decorative 10%, Other Transportation 10%, Auto OEM 6%, Others 19%.

- New Developments:

- For heavy-duty & maintenance coating field, DNT continues to develop new advanced products. In 2022, DNT developed a spray can based on the traditional anti-corrosion paints.

- DNT is developing sustainable coatings with water-borne paints with low temp. curing. Also, DNT is developing new IMC and Ink jet printing coatings which will be offer superior appearance.

- Pt Avia Avian

- Corporate Headquarters Location: Sidoarj Jawa Timur, Indonesia

- Website: avianbrands.com

- Ownership: Public

- Peer Group: AkzoNobel, Nippon Paint, Jotun

- Key Figures

- Total Revenue: IDR69trn (US$451M)

- Paint as a % of Sales: 6%

- Coatings Revenue: IDR46trn (US$368M)

- Geographic Sales: Asia Pacific 100%

- Segment Sales: Decorative 66.9%, Wood Care 7.0%, Other Coatings 8.1%, non-coatings products (pipe and furniture) 18%

- New Developments:

- The company continues to develop and introduce new products. In 2022, the following products were introduced:

- Avitex Anti Viruz Paint line that protects against various viruses and bacteria.

- No Drop Anti Panas paint line which combines waterproofing and heat resistant properties in one product. The waterproofing advantage lies its ability to prevent leaks from the outer walls (negative pressure) . The heat resistant property of this product also provides cooling of the room temperature by up to 7 Celsius.

- Avitex Gold product which was designed to offer consumers a superior product finish by offering smooth painting finishes, the ability to cover wall imperfections, non-fading colors, over 10,000 color choices and a 5-year protection plan.

- Pengupas Cat Tembok product which is a water-based wall paint peeling liquid with the capability to remove/peel up to 24 layers of paint without any risks to irritation to the hands.

- Pacific Paint (Boysen) Philippines, Inc.

- Corporate Headquarters Location: Quezon City, Philippines

- Website: boysenpaints.com

- Ownership: Private

- Peer Group: Asian Coatings, Davies Paints, Roosevelt, United Paints

- Key Figures

- Total Revenue: US$340M (sales estimate)

- Paint as a % of Sales: 100%

- Coatings Revenue: US$340M

- Geographic Sales: Asia Pacific 100%

- Segment Sales: Decorative 100%

- New Developments: Pacific Paint (BOYSEN®) Philippines, Inc. was founded in 1953, focuses on the Filipino decorative coatings market. It continues to grow by developing new products and focusing on quality. It is also focused on sustainability. The company offer high quality paints and coatings. Boysen also makes sure that its facilities adhere to the highest standard in the industry by conducting the best environmental practice.

- Guangdong BARDESE Chemical Company

- Corporate Headquarters Location: Zhongshan City, Guangdong Province, China

- Website: bardese.com

- Ownership: Private

- Peer Group: AkzoNobel, Sherwin-Williams, Carpoly, SK SHU

- Key Figures

- Total Revenue: CN¥2.35bn (US$351M)

- Paint as a % of Sales: 9%

- Coatings Revenue: CN¥2.23bn (US$333M)

- Geographic Sales: Asia Pacific 100%

- Segment Sales: Decorative 45.7%, Industrial Wood 39.4%, Powder 8.5%, General Industrial 6.4%

- New Developments:

- In 2022, Bardese continued its development of new eco-friendly coating products and solutions, such as: waterborne high-performance wood paints, waterborne textured exterior wall paints waterborne industrial floor paints, and powder coatings.

- In the first quarter of 2022, Bardese started production at its new exterior wall paint production plant at its Zhongshan factory. Additionally, in October 2022, Bardese Boshi factory’s new intelligent wood powder coating centre has started operation, which demonstrated one of the most advanced and automated wood powder coating application centres in China.

- Asia Cuanon Technology

- Corporate Headquarters Location: Shanghai, China

- Website: cuanon.com

- Ownership: Public

- Peer Group: Nippon Paint, SK Shu

- Key Figures

- Total Revenue: CN¥2.988bn (US$446M)

- Paint as a % of Sales: 26%

- Coatings Revenue: CN¥2.1bn (US$313M)

- Geographic Sales: Asia Pacific 100%

- Segment Sales: Decorative 100%

- New Developments:

- The company continues to expand its channel network; the number of dealers reached 26,419 at the end of the year, an increase of about 50.28% compared with the end of 2021.

- In 2023, the company plans on the following:

- Continue expanding its distribution network.

- Continue cost reduction and efficiency initiatives.

- Focus on upgrading its brand.

- Continue forward with its digital brand strategy.

- Yung Chi Paint & Varnish MFG

- Corporate Headquarters Location: Kaohsiung, Taiwan

- Website: rainbowpaint.com.tw

- Ownership: Private

- Peer Group: Hempel, Jotun, Nippon Paint, AkzoNobel and PPG

- Key Figures

- Total Revenue: NT$9.736bn (US$327M)

- Paint as a % of Sales: 94%

- Coatings Revenue: NT$9.15bn (US$308M)

- Geographic Sales: Taiwan 69.7%, Mainland China 17.6%, and others 12.7%

- Segment Sales: Decorative 60%, Protective 25%, Coil 10%, and Others 5%.

- New Development:

- Yung Chi business was stable and revenues increases slightly in 2022 in constant currency terms.

- Fujikura Kasei Co Ltd

- Corporate Headquarters Location: Tokyo, Japan

- Website: fkkasei.co.jp

- Ownership: Private

- Peer Group: AkzoNobel, Axalta, BASF, Cashew, Greve, Kansai, Nippon, PPG, Origin Electric, Musashi, Sherwin-Williams

- Key Figures

- Total Revenue: JP¥50.8bn (US$391M)

- Paint as a % of Sales: 5%

- Coatings Revenue: JP¥38.895bn (US$299M)

- Geographic Sales: Asia 65%, North America 26%, and Others 9%

- Segment Sales: Auto OEM for plastics 60%, Decorative 30%, General Industrial 10%.

- New Developments:

- Construction of new plant in Indonesia has begun in 2022.

- Zhuhai Zhanchen New Materials Co. Ltd

- Corporate Headquarters Location: Zhuhai City, China

- Website: zhanchen.cn

- Ownership: Private

- Peer Group: Nippon Paint, Sherwin-Williams, Taiho

- Key Figures

- Total Revenue: CN¥2.0bn (US$290M)

- Paint as a % of Sales: 97%

- Coatings Revenue: CN¥1.94bn (US$290M)

- Geographic Sales: Asia Pacific 100%

- Segment Sales: Furniture 85%, Decorative 10%, and General Industrial 5%.

- New Developments:

- Zhanchen is focused on wood coatings, architecture coatings and other industry coatings.

- Zhanchen has 7 manufacturing centres in Zhuhai, Shanghai, Qingdao, Chengdu,Fuzhou,Puyang and Yuenan.

- Tianjin Dowill

- Corporate Headquarters Location: Tianjin, China

- Website: tjdowill.com

- Ownership: Private

- Peer Group: Sherwin-Williams, Nippon Paint, Kansai Paint, Hempel, Jotun

- Key Figures

- Total Revenue: CN¥1.9bn (US$285M)

- Paint as a % of Sales: 100%

- Coatings Revenue: CN¥1.91bn (US$285M)

- Geographic Sales: Asia 100%

- Segment Sales: Container Coatings 89%, Windmill blades 7%, General Industrial 4%.

- New Developments:

- To partially offset the decline in the container coatings business, Dowill has tried to develop other applications such as Auto OEM coatings. It has built the new factory for Auto OEM coatings in Shanghai.

- Kangnam Jevisco Co Ltd

- Corporate Headquarters Location: Busan, South Korea

- Website: jevisco.com

- Ownership: Publicly traded

- Peer Group: AkzoNobel, Chokwang, KCC, Noroo, and Samwha

- Key Figures

- Total Revenue KRW332.55bn (US$257M)

- Paint as a % of Sales: 98%

- Coatings Revenue: KRW325.9bn (US$252M)

- Geographic Sales: Asia 100% (China, Vietnam, and Korea)

- Segment Sales: Paint 98 % (Decorative, Auto OEM, Auto Refinish, Industrial Wood, General Industrial, Coil, Protective, and Marine.

- New Developments:

- Kangnam Jevisco acquired Eco-Friendly Certification from USDA For PVC Floor Bio-UV Paint

- Premium Eco-Friendly Paint ` Purunsol Dura Shield Primer `technology was Certified by Korea Concrete Institute

- Through a JV established by the company, it has entered the battery market for EVs.

- Zhongshan Daoqum

- Corporate Headquarters Location: Zhongshan, Guangdong, China

- Website: daoqum.com.cn/

- Ownership: Private

- Peer Group: AkzoNobel, PPG, Baotashan, and LeHua,

- Key Figures

- Total Revenue: CN¥1.57bn (US$234M)

- Paint as a % of Sales: 100%

- Coatings Revenue: CN¥1.80bn (US$234M)

- Geographic Sales: Asia 100%

- Segment Sales: General Industrial 60%, ACE 20%, Auto OEM 10%, Protective and Marine 5%, Auto Refinish 5%.

- New Developments:

- Zhongshan Daoqum’s products cover 13 segments including automotive, Commercial Vehicle, Bus & Truck, ACE, Rail, powder, auto refinish, automotive parts, protective and decorative coatings.

- Taiho Paint Products

- Corporate Headquarters Location: Dongguan, Guangdong, China

- Website: taihopaint.com

- Ownership: 100% owned by Samoa Easy Joy International Co., Ltd

- Peer Group: Nippon Paint, Zhanchen, SK Shu, Sherwin-Williams

- Key Figures

- Total Revenue: CN¥1.425bn (US$213M)

- Paint as a % of Sales: 99%

- Coatings Revenue: CN¥1.41bn (US$211M)

- Geographic Sales: Asia 100%

- Segment Sales: Industrial Wood 57%, General Industrial 14.6%, Auto OEM 5%, Others 23.4%

- New Developments:

- Taiho Paint’s main products are industrial wood, decorative coatings and related supporting products like colorants, diluents, solvent, and resins.

- Rock Paint Co Ltd

- Corporate Headquarters Location: Osaka, Japan

- Website: rockpaint.co.jp

- Ownership: Public

- Peer Group: Nippon Paint, Kansai Paint, SK Kaken

- Key Figures

- Total Revenue: JP¥27.67bn (US$213M)

- Paint as a % of Sales: 98%

- Coatings Revenue: JP¥27.1bn (US$209M)

- Geographic Sales: Asia 100%

- Segment Sales: Auto Refinish 33%, General Industrial + Powder 29%, Decorative 24%, Others 14%.

- New Developments:

- Rock Paints has released a new 2K-WB primer based on modified epoxy for anti corrosion applications, such as metal building and parts.

- Le Hua Paint

- Corporate Headquarters Location: Shandong, China

- Website: lehua-china.com

- Ownership: Private

- Peer Group: Baotashan, Jingling, and Lanling,

- Key Figures

- Total Revenue: CN¥1.35bn (US$201M)

- Paint as a % of Sales: 100%

- Coatings Revenue: CN¥1.35bn (US$201M)

- Geographic Sales: Asia 100%

- Segment Sales: General Industrial 91%, Decorative 8%, and Furniture Paint 1%.

- Chokwang Paint Co. Ltd

- Corporate Headquarters Location: Busan, South Korea

- Website: ckpc.co.kr

- Peer Group: Nippon Paint, Kansai Paint, SK Kaken

- Key Figures

- Total Revenue: KRW260.47trn (US$202M)

- Paint as a % of Sales: 98%

- Coatings Revenue: KRW257.87trn (US$200M)

- Geographic Sales: Korea 80%, Asia ex Korea 20%

- Segment Sales: Specialty 40%, Industrial Wood 33%, Decorative 6%, General Industrial 6%, Others 15%

- New Developments:

- Chokwang is focused on improving the environment and thus, is improving the sustainability of its products.

- In 2023, Chokwang is developing the world’s first chemically recycled powder coating material. The material will be produced from waste plastic.

- Yips

- Corporate Headquarters Location: Hong Kong

- Website: baucoatings.com

- Peer Group: Nippon Paint, AkzoNobel, SK Shu, Carpoly

- Ownership: Public

- Key Figures

- Total Revenue: HK$1.64bn (US$210M)

- Paint as a % of Sales: 85%

- Coatings Revenue: HK$1.398bn (US$179M)

- Geographic Sales: Asia 100%

- Segment Sales: Decorative 52%, Industrial Wood 20%, General Industrial 18%, Protective & Marine 10%.

- New Developments:

- Founded in 1982, Bauhinia focuses on Deco, wood, Toy, PC coatings and related resins. The company has three factories in Shanghai, Sichuan and Guangdong.